Sask Party platform touts modest promises, oil sector optimism

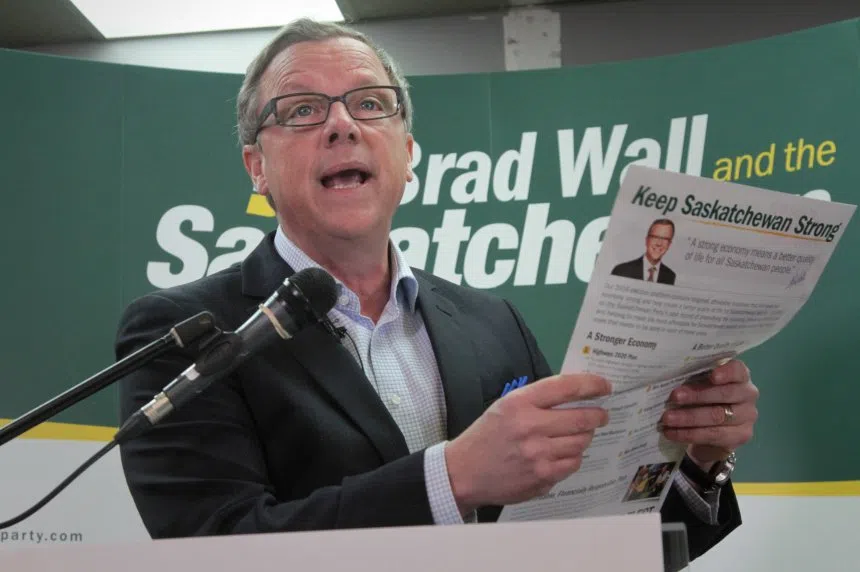

Saskatchewan Party leader Brad Wall says his party is offering residents “affordable ideas” in an election that is all about the economy.

Before a packed Saskatoon-Southeast campaign office Saturday, Wall unveiled the party’s platform which lays out $105.4 million in new spending commitments over four years. Wall said that equals 0.002 per cent of their overall expenditures in a fully-costed platform.

“It’s easy to make a lot a promises. The challenge is keeping them within a fiscally responsible framework and so we didn’t make a lot,” Wall said.

In a platform that relies heavily on the party’s past record, the Sask Party plans to run a $259 million deficit in the upcoming budget, but return to surplus for the 2017-2018 fiscal year.